MI MI-1040CR-7 2021 free printable template

Show details

Reset Form

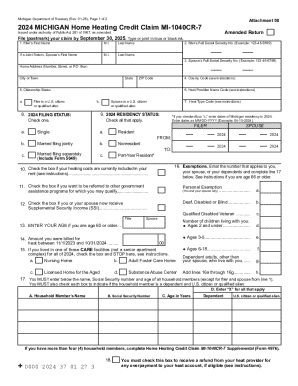

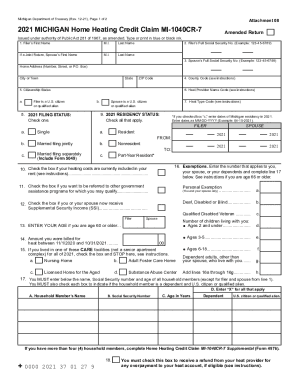

Michigan Department of Treasury (Rev. 0121), Page 1 of 2Attachment 082020 MICHIGAN Home Heating Credit Claim MI1040CR7Amended Refurnished under authority of Public Act 281 of 1967, as amended.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI MI-1040CR-7

Edit your MI MI-1040CR-7 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI MI-1040CR-7 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI MI-1040CR-7 online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI MI-1040CR-7. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI MI-1040CR-7 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI MI-1040CR-7

How to fill out MI MI-1040CR-7

01

Gather all necessary documents, including your W-2s and any other income statements.

02

Download the MI MI-1040CR-7 form from the Michigan Department of Treasury website.

03

Complete your personal information at the top of the form including your name, address, and Social Security number.

04

Indicate your filing status by checking the appropriate box.

05

Fill in the total income and any adjustments as required.

06

Calculate your credits based on eligibility, following the instructions for each credit category.

07

Add up all credits and input the total on the designated line.

08

Review your form for accuracy and ensure all sections are filled out correctly.

09

Sign and date the form at the bottom before submitting.

Who needs MI MI-1040CR-7?

01

Residents of Michigan who are eligible for property tax credits.

02

Individuals who meet the criteria outlined by the Michigan Department of Treasury for the credits available in MI MI-1040CR-7.

03

Homeowners or renters looking to claim a credit on property taxes paid or rent paid.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for Michigan Home Heating credit?

Low-income, deaf, disabled or blind persons, disabled veterans and senior citizens may qualify for the Home Heating Credit. Applicants are not required to file a Michigan individual income tax return to receive the credit, the Treasury said.

What is the mi-1040CR-7 home heating credit?

What is the Home Heating Credit? The Home Heating Credit is a way the State of Michigan helps low-income families pay some of their heating expenses if they are a qualified Michigan homeowners or renters. You should complete the Home Heating Credit Claim MI-1040CR-7 to see if you qualify for the credit.

What is Form MI 1040 CR 7?

What is form Mi-1040CR-7? The State of Michigan provides low-income families with assistance in paying heating costs through partial payments to heating suppliers and/or issuance of checks to taxpayers.

How much do you get for the home heating credit in Michigan?

TABLE A: 2022 Home Heating Credit (MI-1040CR-7) Standard Allowance EXEMPTIONSSTANDARD ALLOWANCEINCOME CEILING0-1$524$14,9572$706$20,1573$888$25,3574$1,069$30,5283 more rows

What is form MI 1040cr7?

MI-1040CR-7. Home Heating Credit Claim. E-file your Michigan Home Heating Credit Claim (MI-1040CR-7) and eliminate. many of the errors that lengthen processing times. E-filed returns are usually processed within 14 business days.

What form do I use for home heating credit in Michigan?

If you are not required to file an MI-1040, you may file your Home Heating Credit Claim by submitting form MI-1040CR-7 only.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MI MI-1040CR-7 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your MI MI-1040CR-7 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get MI MI-1040CR-7?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the MI MI-1040CR-7 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit MI MI-1040CR-7 on an Android device?

You can make any changes to PDF files, such as MI MI-1040CR-7, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is MI MI-1040CR-7?

MI MI-1040CR-7 is a Michigan state tax credit form used to claim the Homestead Property Tax Credit.

Who is required to file MI MI-1040CR-7?

Individuals who own or rent a home in Michigan and meet certain income and residency requirements are required to file MI MI-1040CR-7 to claim the Homestead Property Tax Credit.

How to fill out MI MI-1040CR-7?

To fill out MI MI-1040CR-7, taxpayers must provide their personal information, such as name and address, report their income, and calculate their property taxes or rent paid. Detailed instructions for each section of the form can be found in the form's instruction booklet.

What is the purpose of MI MI-1040CR-7?

The purpose of MI MI-1040CR-7 is to allow eligible Michigan residents to apply for a tax credit that reduces the amount of property tax or rent they have to pay based on their income level.

What information must be reported on MI MI-1040CR-7?

Information that must be reported on MI MI-1040CR-7 includes the taxpayer's personal information, household income, property taxes or rent paid, and any prior year tax credit information if applicable.

Fill out your MI MI-1040CR-7 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI MI-1040cr-7 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.